Growth Capital

Customized equity and debt solutions take your growing company to the next level

For leading technology and healthcare companies, growth is critical and capital is essential. Our flexibility, relationship approach, sector expertise, deep pockets and long-term focus make us an ideal partner for high-growth companies.

The Growth Capital team has a long-standing presence in the growth lending and venture debt ecosystems through a range of capital cycles. Since 2001, we’ve provided approximately $2.7 billion in funding to 200 companies. We understand the challenges and how to use leverage as strategic partners to capitalize on opportunities and take companies to the next level.

Your partners in growth

As your capital needs continue to grow, Growth Capital grows along with you. We invest across the balance sheet, including first lien unitranche, second lien facilities behind bank capital, and equity co-investments. We are enterprise value lenders who can scale our investments from $5 million to $100 million. Our investments include a compelling mix of cost of capital and flexibility to support growing companies.

We offer a variety of debt structures and equity co-investments that can be modified over time to adapt to changing business realities. Our specialties range from senior secured to junior lien to equity, and typically include extended interest-only periods, flexible amortization schedules and covenants and delayed draw capabilities with typical maturities of five years.

Importantly, we bring the same level of attention, enthusiasm, expertise and creativity to every transaction—no matter the size.

~$2.7Bfunding provided

200funded companies since 2001

Our investment criteria

While each of our portfolio companies has its own unique needs, the majority of our borrowers share some common characteristics:

- Growth companies primarily in the technology and healthcare sectors

- Mid- to late-stage growth companies with strong customer validation and unit economics

- Run-rate revenues of $10 million or greater with good top line growth and revenue visibility

- A proven management team with a clear vision for success

- Sustainable product differentiation in an attractive market segment

- Support from a seasoned venture capital firm or growth-focused private equity sponsor

- High margins and operating leverage to drive profitability if needed

Our partnership

- Expert team responds quickly under demanding timetables

- Deep sector expertise across the technology and healthcare sectors with a proven track record in each vertical

- Internally sourced capital eliminates additional approval, funding, or limited partner issues at closing

Representative Investments

All data as of December 31, 2024 unless otherwise noted.

All trademarks and logos are property of their respective owners.

Transactions

-

$47.76 Million

Bridge Loan

Self-Storage Portfolio

Southern U.S.

-

$26.25 Million

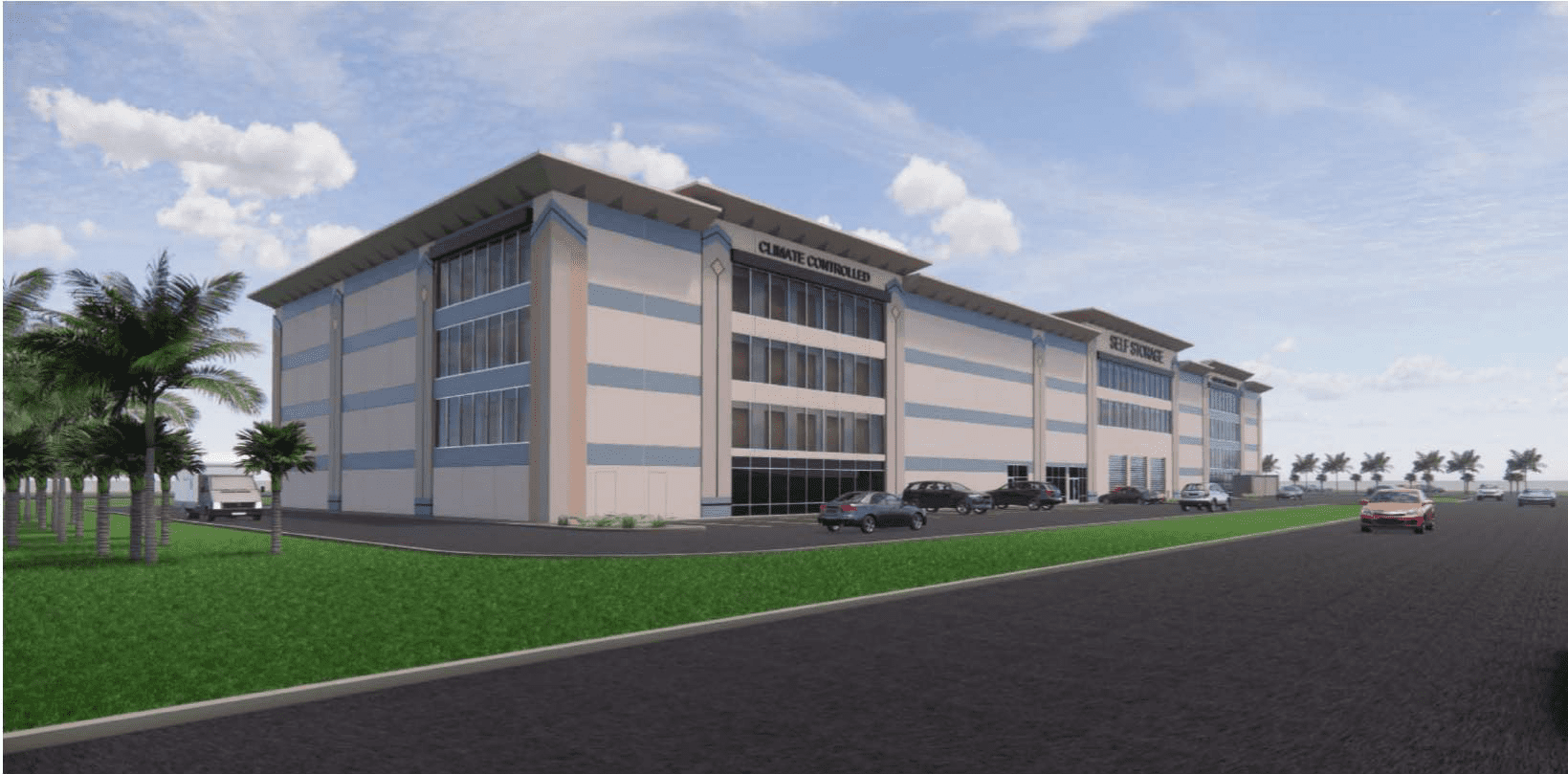

Construction Loan

Self-Storage

California

-

$45.8 Million

Construction Loan

Multifamily

Texas

-

$11 Million

Construction Loan

Self-Storage

Florida

-

$23 Million

Construction Loan

Industrial

New Jersey

-

$25.13 Million

Bridge Loan

Retail

Northeast