Digital Infrastructure

Strategic capital partner with deep sector expertise, supporting the complex needs of businesses across the digital ecosystem

The ORIX USA Digital Infrastructure group makes debt and structured equity investments across the digital infrastructure landscape, including data centers, fiber networks, tower platforms, and related software and services that enable connectivity, cloud computing, and data-intensive applications. Leveraging ORIX USA’s flexible capital base and deep structuring expertise, the group seeks to partner with developers, owners, and operators throughout the asset lifecycle to provide customized financing solutions that support growth, recapitalizations, and acquisitions.

In addition to core digital assets, the group is focused on investing in supporting power and energy infrastructure, such as generation, transmission, distribution, and energy management solutions – all of which are critical to the reliability, scalability, and sustainability of digital platforms.

ORIX USA's Digital Infrastructure group seeks to deliver durable, risk-adjusted returns for investors while serving as a long-term, value-added capital partner to borrowers and portfolio companies

The ORIX USA Digital Infrastructure group expands on ORIX Corporation’s 60+ year legacy of leadership in infrastructure and real asset investing. As patient, long-term investors, the group is focused on providing flexible, solutions-oriented capital supported by ORIX Corporation’s strong financial profile and long-term stability.1 The team directly originates and structures bespoke investments, offering creative and reliable capital solutions that may be unavailable through traditional lenders or public markets. With deep credit expertise and a collaborative approach, ORIX USA’s Digital Infrastructure group strives to serve as a trusted, long-term partner to its clients.

1 As of 12/31/2025, ORIX Corporate (NYSE: IX) had balance sheet assets of $116 billion and was rated BBB+/ A3 / A- by S&P, Moody’s and Fitch, respectively.

Transactions

-

$47.76 Million

Bridge Loan

Self-Storage Portfolio

Southern U.S.

-

$26.25 Million

Construction Loan

Self-Storage

California

-

$45.8 Million

Construction Loan

Multifamily

Texas

-

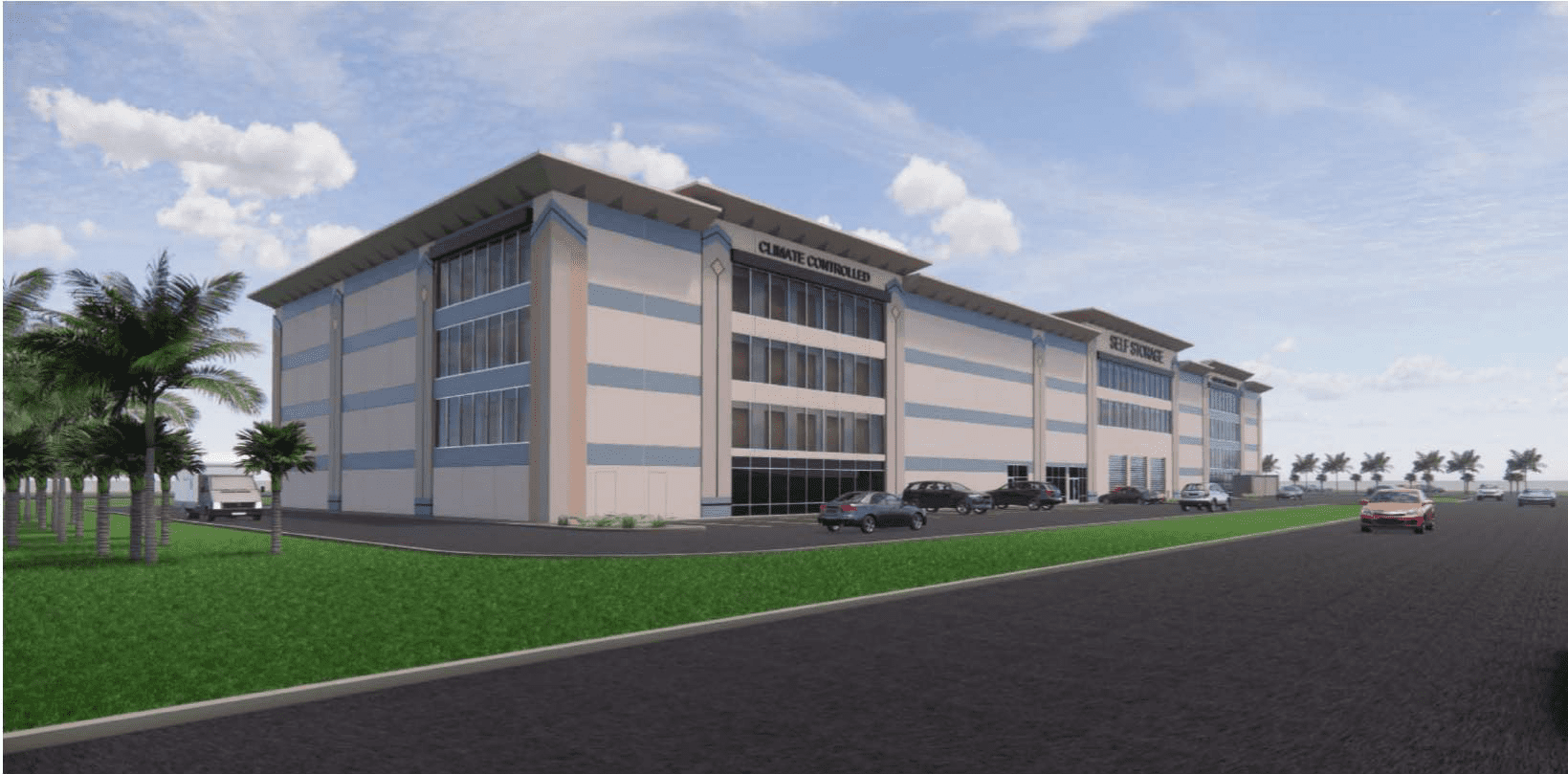

$11 Million

Construction Loan

Self-Storage

Florida

-

$23 Million

Construction Loan

Industrial

New Jersey

-

$25.13 Million

Bridge Loan

Retail

Northeast