Asset-Based Finance

Niche Private Credit Strategy

ORIX USA’s Asset-Based Finance group makes bespoke private loans backed by equipment, esoteric assets, and core-plus infrastructure.

Deal Characteristics

- Hold Size: $20 to $100 million

- Security: Senior and Junior Debt, Structured Equity

- Interest Rate: S+350 – 15%; Ability to PIK interest

Our Target Sectors:

Equipment Finance

- Low-cost financing for large ticket equipment such as aircraft, containers, and railcars, as well as small-ticket equipment including trucks, chassis, yellow-iron, and medical and office equipment

- Work with industry-leading rental, leasing and loan origination platforms to develop structured capital partnerships

Esoteric Assets

- Bespoke capital solutions for niche or emerging asset types such as insurance commission streams, home equity lines of credit, contract receivables, drug royalties, and intellectual property

- Ability to develop an independent risk-reward assessment based on fundamental credit attributes of the underlying asset

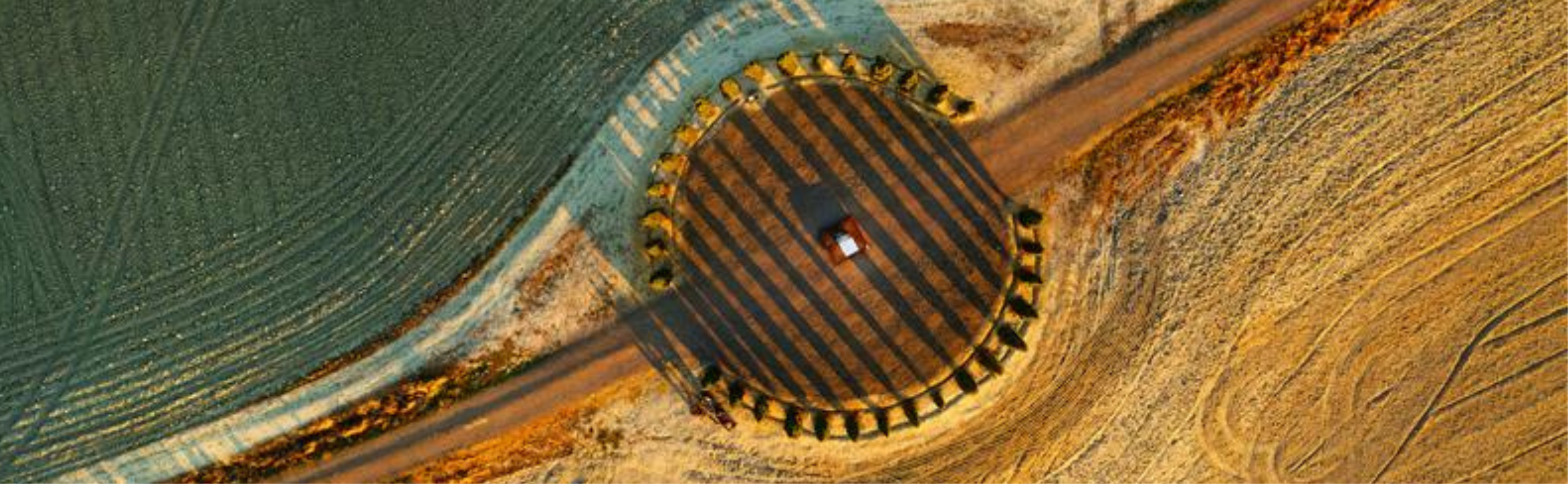

Core-plus Infrastructure

- Customized financing for various types of infrastructure and operating real estate assets such as fiber, cold storage, marinas, homebuilder inventory, farmland, waste and water utilities, etc.

- These companies tend to provide a utility-like service to their customers, have recurring revenue streams, and are often mission-critical to customers’ operations

Key Differentiators

- ORIX Corporation is a strategic investor in specialty finance and infrastructure verticals, and can become an equity investor for the right asset

- >$100 billion investment grade rated balance sheet with low cost of funding

- Thoughtful investment team that seeks to achieve win-win outcomes