Infrastructure and Public Finance

Innovative and flexible private capital solutions

Our Infrastructure and Public Finance group is focused on providing flexible and creative private capital solutions that meet the needs of sponsors primarily in the infrastructure, education and affordable housing sectors, with a secondary focus on other social infrastructure investments. The connection to U.S. public finance means most transactions have a direct or indirect connection to high quality government revenue sources.

Serving the public finance and infrastructure markets since 2008

Our Infrastructure and Public Finance capital solutions offer borrowers flexible structures that might be unavailable in the public markets or from commercial banks. Our origination team directly sources transactions for private placement.

With deep credit and quantitative proficiencies, our experienced investment team has served the public finance and infrastructure markets since 2008. The Infrastructure and Public Finance group is supported by the highly rated financial strength and long-term stability of ORIX Corporation (NYSE: IX), one of the world’s largest public companies*.

*Ranked No. 379 On Forbes’ 2024 Global 2000: World’s Largest Public Companies

~$11BTotal commitments

130Borrowers

$1.2BInvested capital

- Investment Parameters

- Investments of $5 million – $100 million+

- Investment Types

- Tax-exempt or taxable bonds, delayed draw term loans, subordinate debt, purchase of receivables and developer reimbursements, construction lending, lease financing

- Flexible Structures

- Flexible interest only and call features with maturities ranging from 3-30 years; Customized covenants tailored to asset class and/or sponsor; Taxable and tax-exempt private placements

Strategy

Focused on U.S. infrastructure and social infrastructure projects

We are innovative investors and lenders with a deep and experienced team covering all pricing, structuring, legal and credit disciplines. We provide pricing and credit terms for a wide range of high-yield financings and can close transactions as taxable and tax-exempt loans, leases, private placements, limited offerings and public offerings.

Our focus sectors are tax funded infrastructure, schools, and affordable housing – underserved sectors with high quality collateral, demonstrated need and predictable cash flows.

Tax Funded Infrastructure Financing / Special District

We invest in a wide range of real estate tax and sales tax based special district financings. ORIX USA’s Infrastructure and Public Finance group draws from its in-house expertise in real estate, public finance and law to structure adaptive financings based on the development cycle.

Investment Targets

- Commercial/Mixed Use/Economic Development

- Master Planned Communities and Residential Development District Financings

- Commercial and Residential Tax Increment Financing

- Sales, hotel occupancy, PILOT, and other tax financing

Investment Types

- Taxable and tax-exempt bonds and loans

- Receivables and developer reimbursements

Education

We leverage our industry-leading expertise to provide capital to the education sector.

Investment Targets

- Charter Schools

- Private K-12 Schools

- Student Housing

Investment Types

- Taxable and tax-exempt bonds and loans

- Mezzanine and subordinate debt

- Preferred equity

Affordable Housing

Flexible debt financing solutions for new construction and renovation of multifamily units for tenants with income restrictions.

Investment Targets

- Projects where a portion of project equity comes in the form of Low-Income Housing Tax Credits

Investment Types

- Fixed rate loans and bonds

All data as of March 31, 2025 unless otherwise noted.

Transactions

-

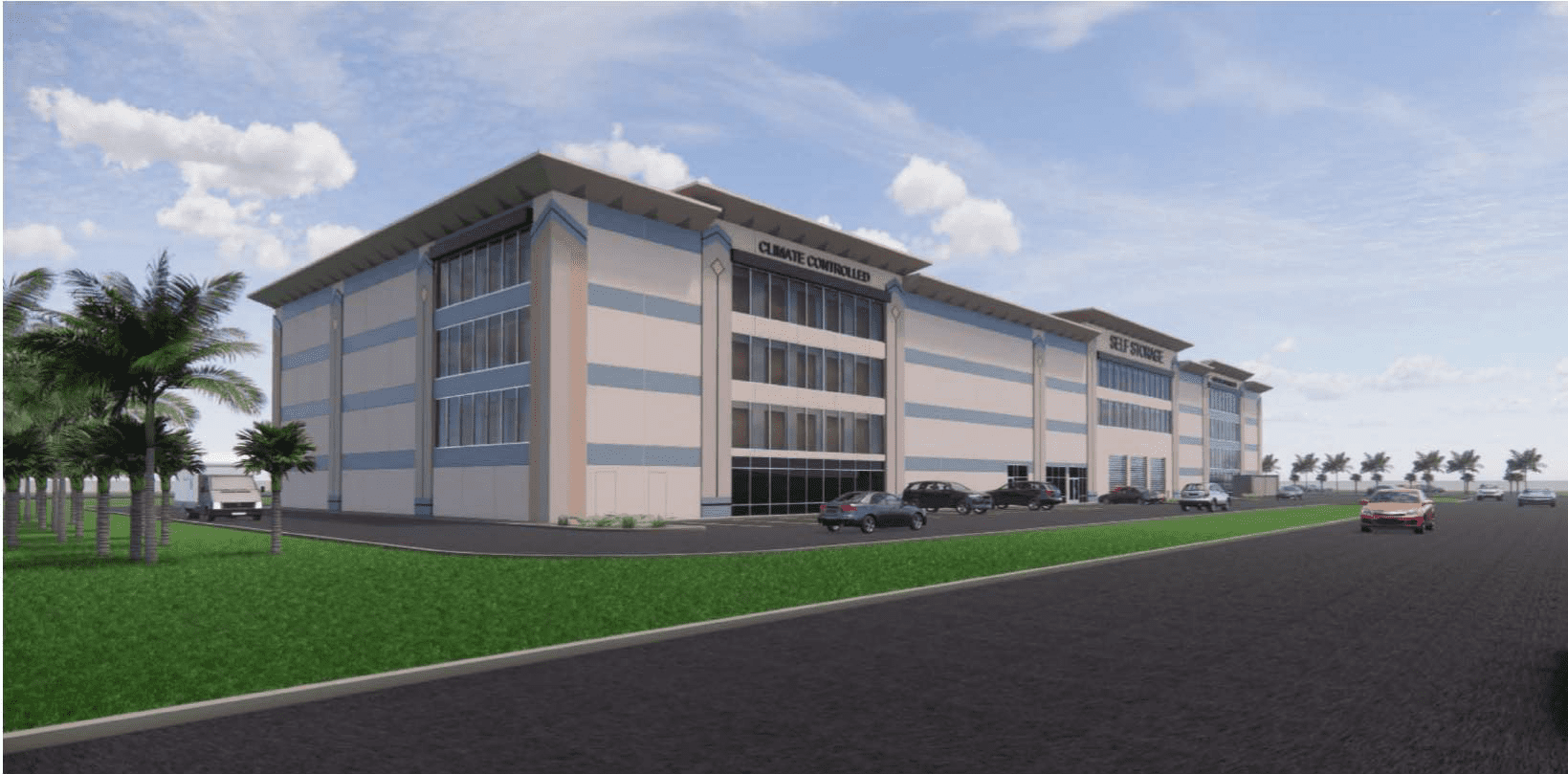

$47.76 Million

Bridge Loan

Self-Storage Portfolio

Southern U.S.

-

$26.25 Million

Construction Loan

Self-Storage

California

-

$45.8 Million

Construction Loan

Multifamily

Texas

-

$11 Million

Construction Loan

Self-Storage

Florida

-

$23 Million

Construction Loan

Industrial

New Jersey

-

$25.13 Million

Bridge Loan

Retail

Northeast